how are property taxes calculated in martin county florida

The median property tax also known as real estate tax in Martin County is 231500 per year based on a median home value of 25490000 and a median effective property tax rate of 091 of property value. Pay for confidential accounts.

Keeping Them Flying Martin County Sheriff S Office Vertical Mag

In other words you can calculate the transfer tax in the following way.

. This equates to 1 in taxes for every 1000 in home value. Campos Tax Services Edinburg Tx. Here are the median property tax payments and average effective tax rate by Florida county.

Enter 555 Main when trying to locate the property at 555 SE Main Street Stuart FL. Citizens Guide to Property tax. How do I calculate my property tax.

Tax bill 101 how to understand your bill. Dinner Restaurants Near Me Reservations. This is equal to the median property tax paid as a.

Real Property records can be found using the Parcel ID Account Number Subdivision Address or Owner Last Name. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Martin County. Search and Pay Business Tax.

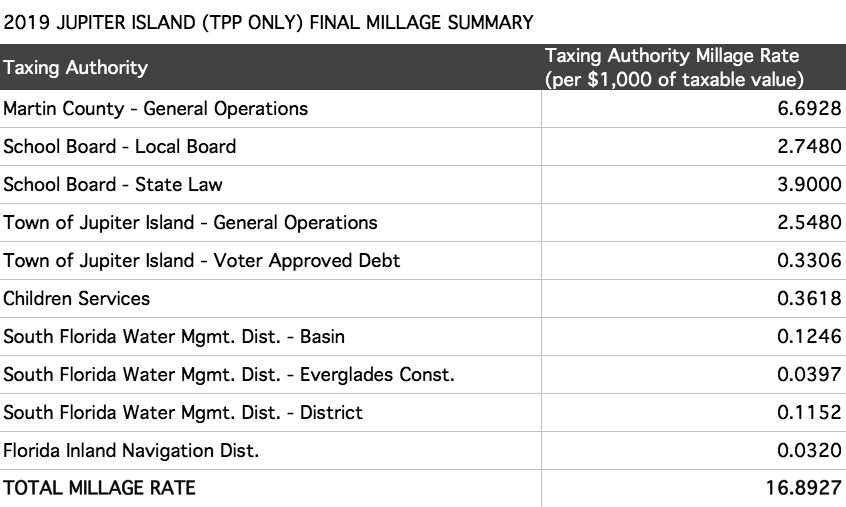

The taxes due on a property are calculated by multiplying the taxable value of the property by the. Base tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. Martin County has one of the highest median property taxes in the United States and is ranked 323rd of the 3143 counties in order.

The median property tax on a 18240000 house is 191520 in the United States. Typically Broward County Florida property taxes are decided as a percentage of the propertys value. How Are Property Taxes Calculated In Polk County Florida.

The Ad VAlorem portion of the tax is calculated basically by multiplying the tax millage rate by the tax assessed value of the property. Base tax is calculated by multiplying the propertys assessed value by the millage rate applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. Were here to help you.

Complete the Application for Local Business Tax Receipt. Enter a name or address or account number etc. In our calculator we take your home value and multiply that by your countys effective property tax rate.

Total Price100 x 70 Doc Stamps Cost. Municipalities like Jupiter and Palm Beach Gardens. Sales Tax Reno Nv 2021.

When searching by address enter street number and street name only. If you dont pay your property tax by the end of September there will be a tax assessment of 3600. Divided in two parts the first half of the homestead exemption 25000 is for all property taxes including school district taxes and the second half up to 25000 is dependent on the propertys assessed value thats between 50000 and.

Beginning on or before June 1st the law requires the Tax Collector to hold a Tax Certificate Sale. In Jackson County Missouri residents pay an average effective property tax rate of 135. The median property tax on a 25490000 house is 267645 in the United States.

Choose RK Mortgage Group for your new mortgage. Martin County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. One mill equals 100 per 100000 of property value.

Now the millage rate varies depending upon what area of the county the property is in and if the property is in an incorporated are of the county. The sale allows citizens to buy certificates by paying the owed tax debt. Actual property tax assessments depend on a number of variables.

Overview of Jackson County MO Taxes. Where tax dollars are spent in Indiana. The rates are expressed as millages ie the actual rates multiplied by 1000.

Please enter the information below for the current tax year to view and pay your bill. Martin County collects on average 091 of a propertys assessed fair market value as property tax. Actual amounts for property taxes homeowners insurance and HOA fees may be higher and are subject to change from time to time.

Outside of Miami-Dade County the transfer tax rate is 70 cents per 100 of the deeds consideration. Tax amount varies by county. Miami-Dade County like most Florida counties has an additional county sales surtax of 1.

Florida real property tax rates are implemented in millage rates which is 110 of a percent. The tax is imposed on the sale or rental of goods the sale of admissions. Carrico Martin County Treasurer 129 Main St PO Box 359 Shoals IN 47581 P.

The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board City Commissioners and other taxing authorities set the millage rates. Enter a name or address or account number etc. A tax certificate when purchased becomes an enforceable first lien against the real estate.

The tax year runs from January 1st to December 31st. Mandarin Chinese Restaurant Lahore. View 2021 Millage Rates.

Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to. County property appraisers. Pay personal property judgments online.

The median property tax in Martin County Florida is 2315 per year for a home worth the median value of 254900. In Harris County where Houston is located the average effective property tax rate is 203.

Brevard County Fl Property Tax Search And Records Propertyshark

Broward County Fl Property Tax Search And Records Propertyshark

Florida Income Tax Calculator Smartasset

4596 Se Murray Cove Cir Stuart Fl 34997 Realtor Com

2022 Best Places To Buy A House In Martin County Fl Niche

Duval County Fl Property Tax Search And Records Propertyshark

Duval County Fl Property Tax Search And Records Propertyshark

Are The Taxes Lower In Martin County Than Palm Beach County 2019 R R Realty Jupiter Real Estate

St Lucie County Fl Property Tax Search And Records Propertyshark

Palm Beach County Fl Property Tax Search And Records Propertyshark

Volusia County Fl Property Tax Search And Records Propertyshark

Polk County Fl Property Tax Search And Records Propertyshark

Palm Beach County Fl Property Tax Search And Records Propertyshark

Palm Beach County Property Taxes

Miami Dade County Fl Property Tax Search And Records Propertyshark

Florida Property Tax H R Block

Florida Vehicle Sales Tax Fees Calculator

Broward County Fl Property Tax Search And Records Propertyshark